Search results

An arithmetic progression (AP) or arithmetic sequence is a sequence of numbers such that the difference between the consecutive terms is constant and is ... more

The cost of capital is a term used in the field of financial investment to refer to the cost of a company’s funds (both debt and equity). Equity is ... more

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) is a way to examine the performance ... more

In finance, return is a profit on an investment. return is also used to refer to a profit on an investment, expressed as a proportion of the amount ... more

In finance, the capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return of an ... more

In Valuation (finance), tax amortization benefit (or tax amortisation benefit) refers to the present value of income tax savings resulting from the tax ... more

The Sortino ratio measures the risk-adjusted return of an investment asset, portfolio, or strategy. It is a modification of the Sharpe ratio but penalizes ... more

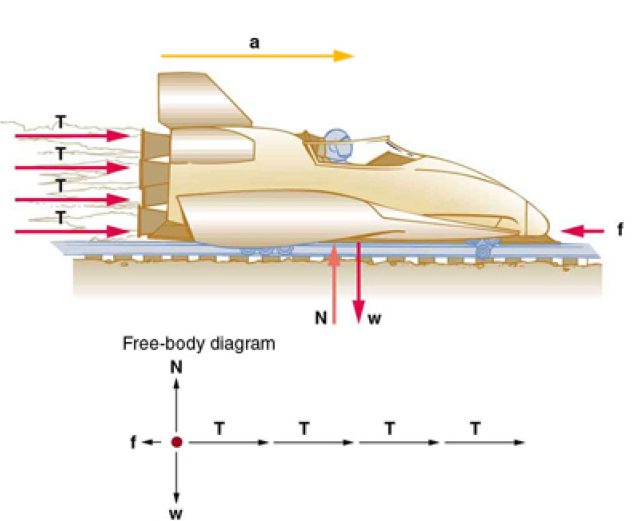

A sled experiences a rocket thrust that accelerates it to the right.Each rocket creates an identical thrust T . As in other situations where there is only horizontal acceleration, the vertical forces cancel. The ground exerts an upward force N on the system that is equal in magnitude and opposite in direction to its weight,w.The system here is the sled, its rockets, and rider, so none of the forces between these objects are considered. The arrow representing friction ( f ) is drawn larger than scale.

Assumptions: The mass of the Sled remains steady throughout the operation

Strategy

Although there are forces acting vertically and horizontally, we assume the vertical forces cancel since there is no vertical acceleration. This leaves us with only horizontal forces and a simpler one-dimensional problem. Directions are indicated with plus or minus signs, with right taken as the positive direction. See the free-body diagram in the figure.

Solution

Since acceleration, mass, and the force of friction are given, we start with Newton’s second law and look for ways to find the thrust of the engines. Since we have defined the direction of the force and acceleration as acting “to the right,” we need to consider only the magnitudes of these quantities in the calculations. Hence we begin with

Fnet is the net force along the horizontal direction, m is the rocket’s mass and a the acceleration.

We can see from the Figure at the top, that the engine thrusts add, while friction opposes the thrust.

Tt is the total thrust from the 4 rockets, Fnet the net force along the horizontal direction and Ff the force of friction.

Finally, since there are 4 rockets, we calculate the thrust that each one provides:

T is the individual Thrust of each engine, b is the number of rocket engines

Reference : OpenStax College,College Physics. OpenStax College. 21 June 2012.

http://openstaxcollege.org/textbooks/college-physics

Creative Commons License : http://creativecommons.org/licenses/by/3.0/

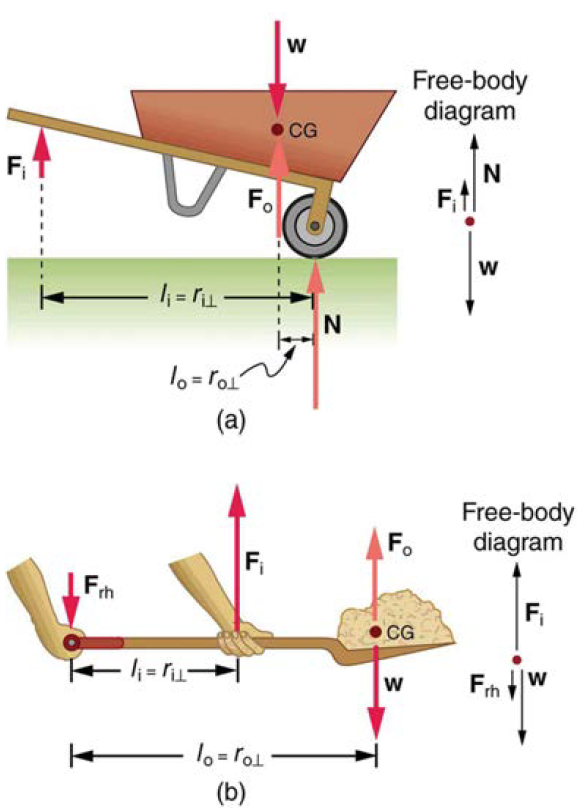

In the wheelbarrow of the following figure the load has a perpendicular lever arm of 7.50 cm, while the hands have a perpendicular lever arm of 1.02 m.(a) What upward force must you exert to support the wheelbarrow and its load if their combined mass is 45.0 kg? (b) What force does the wheelbarrow exert on the ground?

(a) In the case of the wheelbarrow, the output force or load is between the pivot and the input force. The pivot is the wheel’s axle. Here, the output force is greater than the input force. Thus, a wheelbarrow enables you to lift much heavier loads than you could with your body alone. (b) In the case of the shovel, the input force is between the pivot and the load, but the input lever arm is shorter than the output lever arm. The pivot is at the handle held by the right hand. Here, the output force (supporting the shovel’s load) is less than the input force (from the hand nearest the load), because the input is exerted closer to the pivot than is the output.

Strategy

Here, we use the concept of mechanical advantage.

Discussion

An even longer handle would reduce the force needed to lift the load. The MA here is:

Reference : OpenStax College,College Physics. OpenStax College. 21 June 2012.

http://openstaxcollege.org/textbooks/college-physics

Creative Commons License : http://creativecommons.org/licenses/by/3.0/

Security market line (SML) is the representation of the capital asset pricing model. It displays the expected rate of return of ... more

...can't find what you're looking for?

Create a new formula

Prior to manned space flights, rocket sleds were used to test aircraft, missile equipment, and physiological effects on human subjects at high speeds. They consisted of a platform that was mounted on one or two rails and propelled by several rockets. Calculate the magnitude of force exerted by each rocket, called its thrust T , for the four-rocket propulsion system shown in the Figure below. The sled’s initial acceleration is 49 m/s 2, the mass of the system is 2100 kg, and the force of friction opposing the motion is known to be 650 N.