Search results

Dividend cover is the ratio of company’s earnings (net income) over the dividend paid to shareholders, calculated as earnings per share divided by ... more

Dividend payout ratio is the fraction of net income a firm pays to its stockholders in dividends. The part of the earnings not paid to investors is left ... more

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a ... more

Envy ratio in finance is the ratio of the price paid by investors to that paid by the management team for their respective shares of the equity. This ... more

The dividend discount model is a method of valuing a company’s stock price based on the theory that its stock is worth the sum of all of its future ... more

In finance, volatility is a measure for variation of price of a financial instrument over time. An implied volatility is derived from the market price of a ... more

Earnings per share is the monetary value of earnings per each outstanding share of a company’s common stock. When preferred shares are cumulative, ... more

Earnings per share is the monetary value of earnings per each outstanding share of a company’s common stock. Shares outstanding are all the shares of a ... more

Earnings per share is the monetary value of earnings per each outstanding share of a company’s common stock. In business, net income – also ... more

The current yield, interest yield, income yield, flat yield, market yield, mark to market yield or running yield is a financial term used in reference to ... more

The weighted average cost of capital is the rate that a company is expected to pay on average to all its security holders to finance its assets. It is the ... more

In finance, holding period return (HPR) is the total return on an asset or portfolio over the period during which it was held. It ... more

In finance, return is a profit on an investment. It comprises any change in value, and interest or dividends or other such cash flows which the investor ... more

In finance, volatility is a measure for variation of price of a financial instrument over time. return is a profit on an investment. It comprises any ... more

The Black–Scholes /ˌblæk ˈʃoʊlz/ or Black–Scholes–Merton model is a mathematical model of a financial market containing derivative investment instruments. ... more

In finance, return is a profit on an investment. It comprises any change in value, and interest or dividends or other such cash flows which the investor ... more

The current yield, interest yield, income yield, flat yield, market yield, mark to market yield or running yield is a financial term used in reference to ... more

Compound annual growth rate is a business and investing specific term for the geometric progression ratio that provides a constant rate of return over the ... more

Compound annual growth rate is a business and investing specific term for the geometric progression ratio that provides a constant rate of return over the ... more

In financial accounting, an asset is an economic resource. Anything tangible or intangible that is capable of being owned or controlled to produce value ... more

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is the sale of securities together with an agreement for the seller to ... more

n financial accounting, an asset is an economic resource. Anything tangible or intangible that is capable of being owned or controlled to produce value and ... more

A geosynchronous orbit (sometimes abbreviated GSO) is an orbit around the Earth with an orbital period of one sidereal day ... more

Days in inventory is an efficiency ratio that measures the average number of days the company holds its inventory before selling it. Cost of goods sold or ... more

In finance, the capital asset pricing model is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be ... more

Monetarists assert that the empirical study of monetary history shows that inflation has always been a monetary phenomenon. The quantity theory of money, ... more

The quantity theory of money, says that any change in the amount of money in a system will change the price level. The equation of exchange is the ... more

In biology or human geography, population growth is the increase in the number of individuals in a population.

The “population growth ... more

Security market line (SML) is the representation of the capital asset pricing model. It displays the expected rate of return of ... more

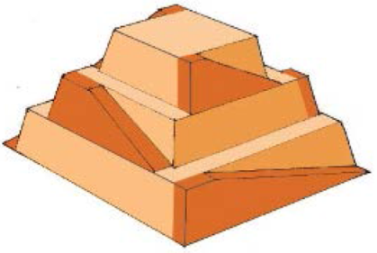

a) Calculate the gravitational potential energy stored in the pyramid, given its center of mass is at one-fourth its height.

b) Only a fraction of the workers lifted blocks; most were involved in support services such as building ramps, bringing food and water, and hauling blocks to the site. Calculate the efficiency of the workers who did the lifting, assuming there were 1000 of them and they consumed food energy at the rate of 300 Kcal/hour.

first we calculate the number of hours worked per year.

then we calculate the number of hours worked in the 20 years.

Then we calculate the energy consumed in 20 years knowing the energy consumed per hour and the total hours worked in 20 years.

The efficiency is the resulting potential energy divided by the consumed energy.

...can't find what you're looking for?

Create a new formula

The awe‐inspiring Great Pyramid of Cheops was built more than 4500 years ago. Its square base, originally 230 m on a side, covered 13.1 acres, and it was 146 m high (H), with a mass of about 7×10^9 kg. (The pyramid’s dimensions are slightly different today due to quarrying and some sagging). Historians estimate that 20,000 workers spent 20 years to construct it, working 12-hour days, 330 days per year.